The state of New Jersey has raised minimum liability coverage (BIPD) for all who have commercial vehicles registered with the State of NJ.

Recently I sent the following email to all my insureds:

To all of my insureds (customers),

***IMPORTANT***

If you or any of your trucks travel into or through New Jersey please contact me immediately.

New Jersey has new increased minimum BIPD insurance coverage for all commercial vehicles that travel into or through New Jersey.

Each insurance company is addressing New Jersey’s new insurance requirement differently. Some insurance carriers will require a change of policy to meet the New Jersey increase, others will not provide insurance if you or any of your trucks travel into or through New Jersey and others require no change at all.

For those of you who have any of your trucks traveling into or through New Jersey – It is imperative for us to review your policy together to make certain you have the coverage you are required to have. So please contact me as soon as possible. Thank you very much!

The reason insurance companies are each addressing the issue differently is because of the language of the New Jersey law and states rights to set their own minimum coverages. In case you were not aware, states do set their own minimum coverage amounts for auto insurance coverages. This is the first effort I know of for commercial auto coverage where a state says “we require more than the federal minimum required.” This is similar to CARB (California Air Resources Board) raising it’s emissions standards in California beyond the EPA (Environmental Protection Agency) national standards. Both of these factors weigh heavily to understanding why this has caused such a horrible problem.

Disclaimer: I am not an attorney and this is not legal advice. Please consult an attorney to receive legal advice or guidance pertaining to any of the following. The new law states in part:

SYNOPSIS

Raises minimum amount of liability coverage for commercial motor vehicles to $1,500,000.

CURRENT VERSION OF TEXT

As introduced.

An Act concerning commercial motor vehicle coverage and amending P.L.1972, c.197.

Be It Enacted by the Senate and General Assembly of the State of New Jersey:

1. Section 1 of P.L.1972, c.197 (C.39:6B-1) is amended to read as follows:

1. a. Every owner or registered owner of a motor vehicle registered or principally garaged in this State shall maintain motor vehicle liability insurance coverage, under provisions approved by the Commissioner of Banking and Insurance, insuring against loss resulting from liability imposed by law for bodily injury, death and property damage sustained by any person arising out of the ownership, maintenance, operation or use of a motor vehicle wherein such coverage shall be at least in: (1) an amount or limit of $15,000.00, exclusive of interest and costs, on account of injury to, or death of, one person, in any one accident; and (2) an amount or limit, subject to such limit for any one person so injured or killed, of $30,000.00, exclusive of interest and costs, on account of injury to or death of, more than one person, in any one accident; and (3) an amount or limit of $5,000.00, exclusive of interest and costs, for damage to property in any one accident; and (4) for a commercial motor vehicle, an amount or limit of $1,500,000, exclusive of interest and costs, on account of injury to or death of, one or more persons in any one accident or for damage to property in any one accident.

The literal interpretation of this language makes it’s crystal clear that if a vehicle is register to operate within NJ it is subject to this law. All IRP (International Registration Plan) registered vehicles are in fact registered in the state of NJ. This language does not differentiated between intrastate vehicles or interstate vehicles. Put another way, it doesn’t exempt IRP apportioned registrations from the law.

To my knowledge NJ has not made any public statement as to how the law will be enforced. There in lies one hurdle that is causing different approaches by the insurance companies. Some insurance companies expect that NJ will enforce the law as it is literally written. That is to say, as I have described above. Other insurance companies hope/anticipate that NJ will announce that this is only for NJ domiciled owners and/or registered vehicles. Still other insurance companies expect that the courts will decide how this law is enforced. Some of those insurance companies are sitting on the sideline waiting to see who hits this landmine first and hoping it’s not one of their insureds.

Why does all this matter? Because it leaves the door wide open for an insurance stalker (AKA lawyer) to argue that an IRP apportioned carrier is in fact, while in the State of New Jersey, required to have the New Jersey minimum coverage and force a insurance carrier to provide a settlement to an injured third party of $1.5 million instead of the FMCSA required minimum of $750K.

As an example, lets say for the moment that NJ announces that this new minimum liability coverage requirement is only being enforced for NJ domiciled owners and registered vehicles. 6 months later a Pennsylvania IRP registered trucking company is at fault for an accident on I95 in NJ similar in liability damages (bodily injury and property damage to injured third parties) to one of these accidents reported by Overdrive:

Trucker charged with vehicular homicide in fiery crash on I-70 near Denver

As for my example, is there any doubt that even a reasonably competent insurance stalker (AKA lawyer) could successfully argue that the injured third party, according to the literal reading of the law, was legally due the $1.5 million of minimum liability coverage from the insured (trucking company from PA) and their insurance company? Obviously not.

Many in the insurance industry believe (including myself) that this is likely to be enforced for everyone who has a commercial vehicle registered in the State no matter if it’s intrastate or interstate. Even if not immediately, it is expected that eventually it will be required for all who cross into NJ.

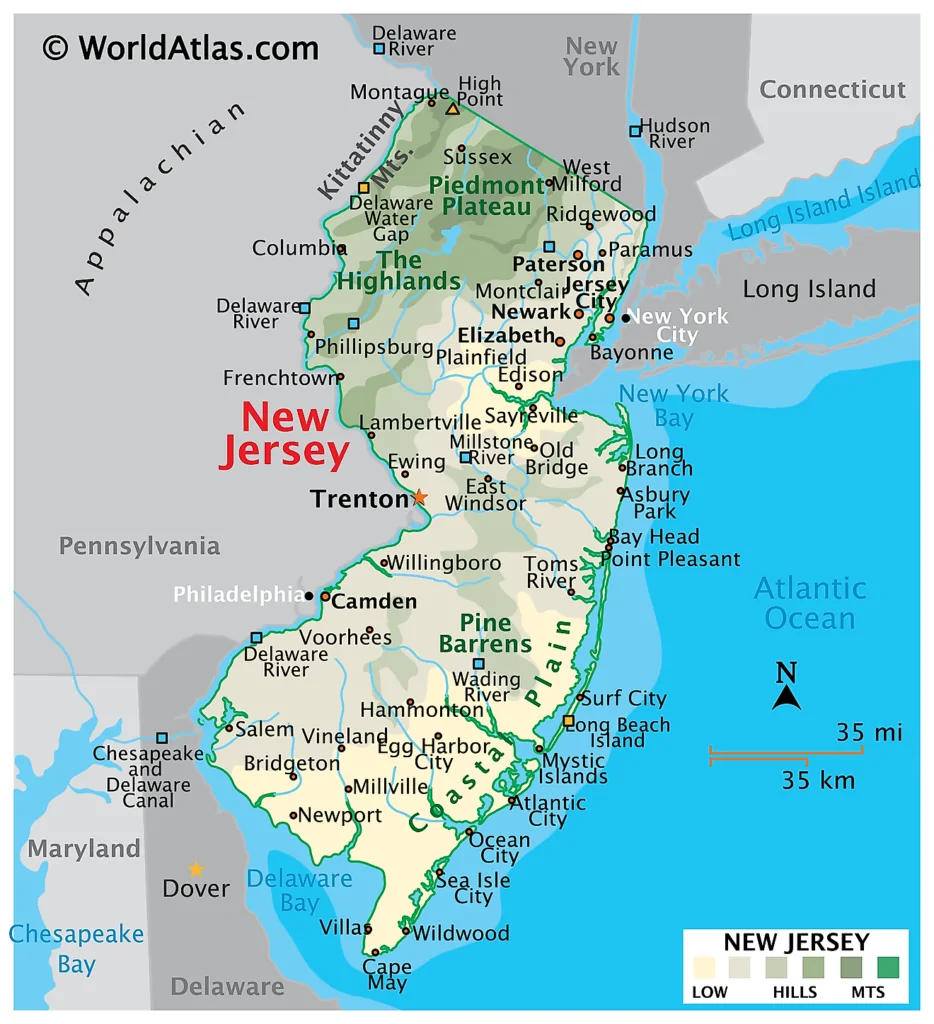

As for me, Joel baker truck driver, and my trucks, I will treat New Jersey just like I did California when CARB implemented such outrageous emission regulations for CA. New Jersey is another page I’ve torn out of my atlas because I’m not going back.